BLOG DETAIL

Why Credit Limits Are Critical for Sustainable B2B Growth

Raja Moorthy

January 09, 2026 | 95 Views | 1 Min Read

Learn how built-in credit limits in SpurtCommerce protect cash flow, reduce risk, and enable sustainable growth for B2B commerce platforms.

In B2B commerce, growth itself rarely breaks systems.

What breaks them is uncontrolled credit.

This is something SpurtCommerce has observed repeatedly across B2B platforms. While many systems focus heavily on catalogs, pricing, and order flows, credit limits are still managed outside the platform, in spreadsheets, emails, or disconnected finance tools.

That approach introduces unnecessary risk.

Credit Limits Are a Business Control, Not Just a Finance Rule

Credit limits are often treated as a back-office finance policy.

In reality, they are a core business control that directly affects cash flow, trust, and operational stability.

When credit limits are disconnected from the buying journey:

- Buyers place orders without visibility into their credit position

- Finance teams step in at the last minute

- Orders get delayed or blocked

- Relationships between buyers and sellers become strained

This friction slows growth and increases risk.

What Changes When Credit Limits Are Built into the Buying Flow

When credit limits are embedded directly into the commerce platform, everything becomes more predictable:

- Buyers clearly see their available credit before placing orders

- Finance teams control exposure without interrupting sales

- Orders proceed smoothly without last-minute stops

- Trust improves because expectations are transparent

Credit becomes part of the workflow, not a surprise after checkout.

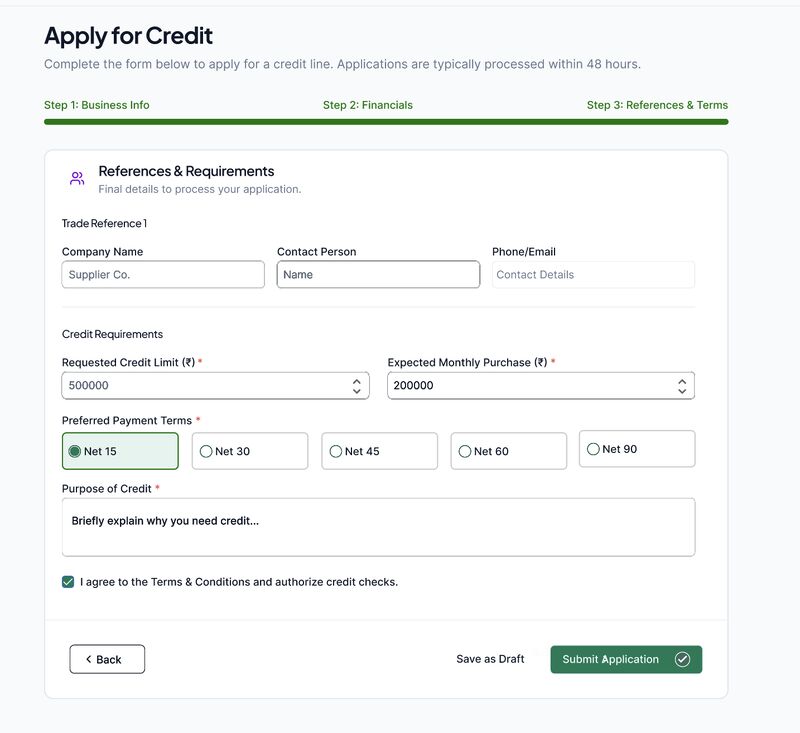

How SpurtCommerce Handles Credit Limits in B2B Commerce

SpurtCommerce integrates credit limits directly into the purchasing experience, allowing them to operate quietly in the background.

The platform ensures that:

- Credit limits are enforced automatically

- Orders respect approved credit thresholds

- Finance policies are applied consistently

- Sales teams continue operating without manual intervention

This balance protects cash flow while keeping business moving forward.

Why This Matters for Long-Term B2B Growth

Uncontrolled credit doesn’t show its impact immediately.

But over time, it leads to delayed payments, strained finances, and operational instability.

By embedding credit limits into the platform:

- Risk is managed proactively

- Cash flow becomes more predictable

- Sales and finance work in alignment

- Growth remains controlled and sustainable

This is how B2B platforms scale responsibly.

Conclusion

Credit limits don’t slow B2B commerce.

They make it sustainable.

By treating credit limits as a built-in business control rather than an afterthought, SpurtCommerce helps businesses grow with confidence, protecting cash flow while enabling seamless buying experiences.

In B2B commerce, sustainable growth isn’t about selling more.

It’s about selling smart.

En

En Es

Es Ar

Ar